How We Can Help

About Financial Education

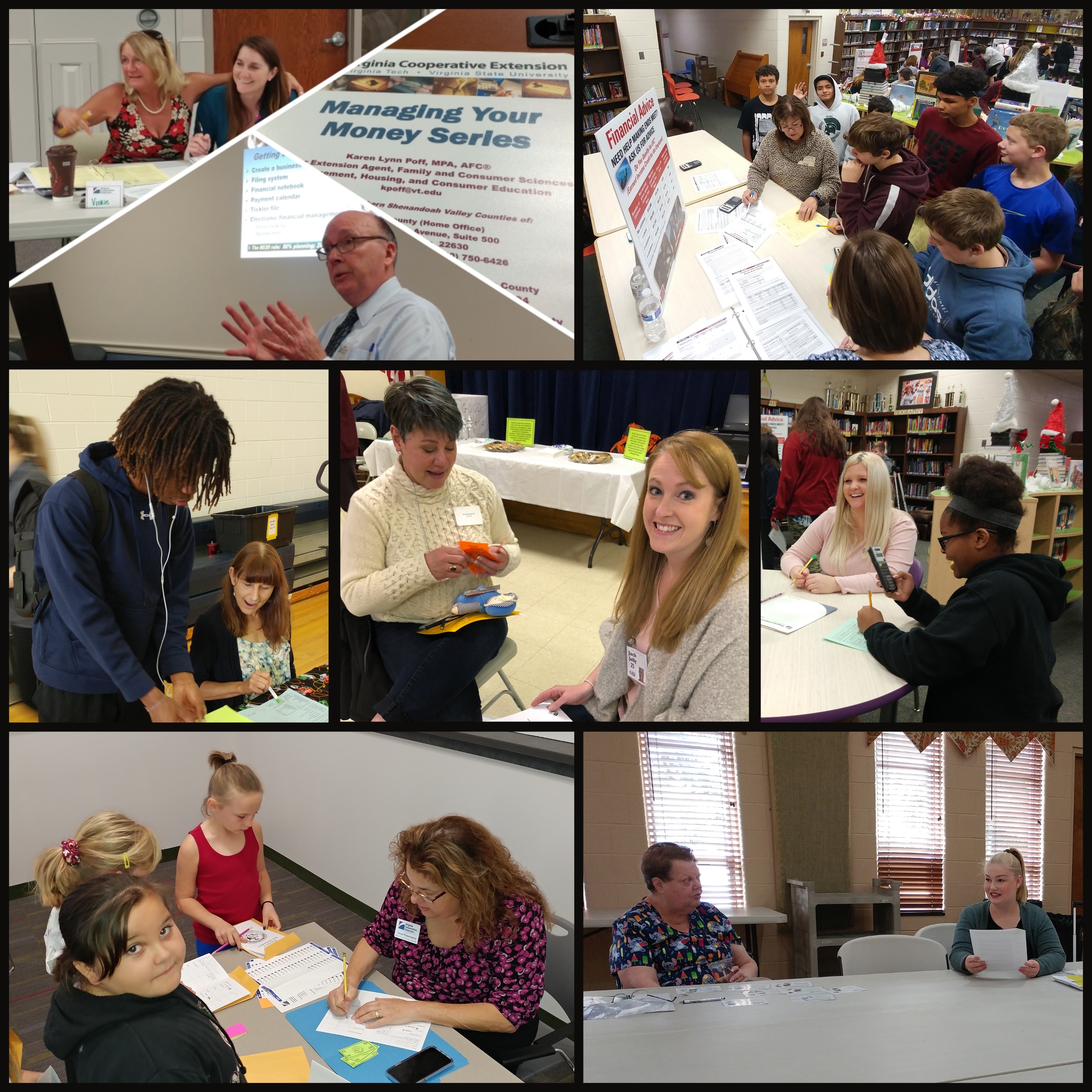

People from all walks of life can benefit from financial education. Regardless of your situation, we are here to help! We have trained financial education volunteers ready to assist you in a variety of ways. Below is a list of some of the programs we offer. If you are interested in any of the programs listed or wish to know more about other opportunities, please contact us!

Programs

Our most important goal is to meet the needs in our area for financial education. We can work with you to develop customized programs for your employees, clients, members, and students. Our schedules are flexible and we can work within the timeframe you have available. Just contact us to discuss how our volunteers might be able to assist you. Here are some of the programs we already have available: